Why Nickel: Class 1 vs. Class 2 Nickel

The global nickel market can be subdivided into two main commodity segments, where nickel is used in the:

Rapidly expanding electric vehicles (EVs) market, where it is predominately used in the rechargeable batteries market. Only nickel with the highest purity, also known as Class 1 nickel, is suitable for use in batteries. These are found in nickel sulfide deposits like the Zeb Nickel Project.

Stainless steel market. Nickel with a lower purity can be used for this market and is also referred to as Class 2 nickel, which are typically sourced from nickel laterite deposits.

The main differences between Class 1 and Class 2 nickel can be summarized as follows:

| Description | Class 1 Nickel | Class 2 Nickel |

|---|---|---|

| Purity | Higher Purity (>99.8% Ni), Lower Iron content | Lower Purity (<99.8% Ni), Higher Iron content |

| Costs | Expensive to mine, cheap to process | Cheap to mine, expensive to process |

| Environmental | Lower Environmental Impact and Cost | Greater Environmental Impact and Cost |

| Uses | Cathodes in Batteries, plating, foundry, and super-alloys | Stainless Steel |

| Geology | Nickel Sulfide Ore | Laterite Ore |

| Products | LME Deliverables, such as Electrolytic nickel, powders and briquettes. | Not LME deliverable and must be sold to end customer such as Ferronickel (2%-45% Ni) & Nickel Pig Iron (2%-17% Ni) |

| Major Producing Countries | Canada Russia China Australia |

Indonesia Philippines |

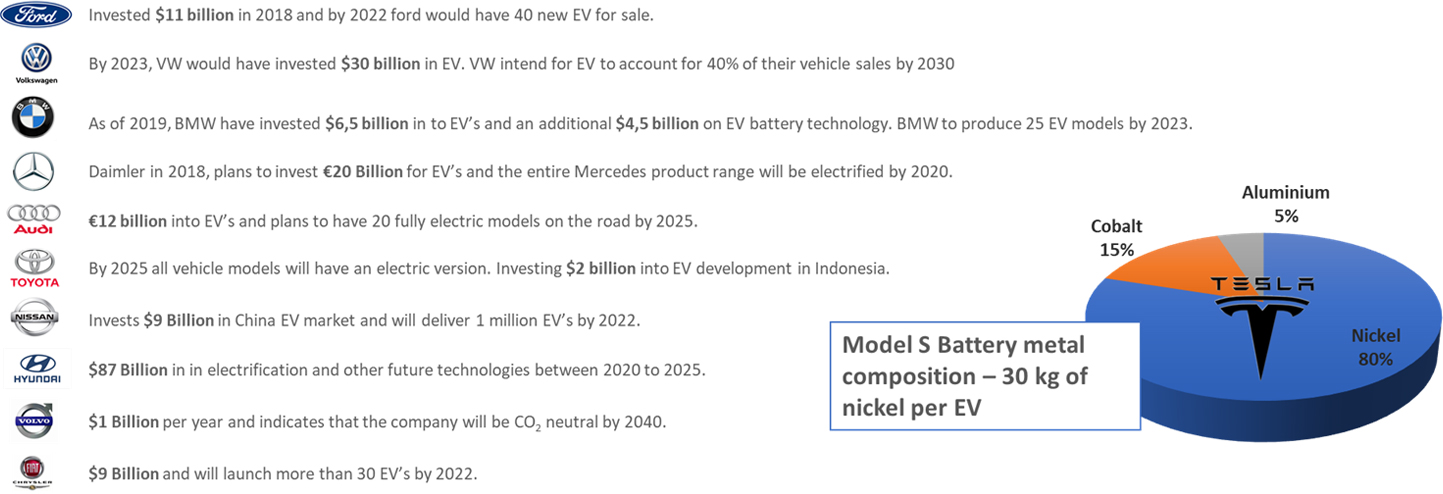

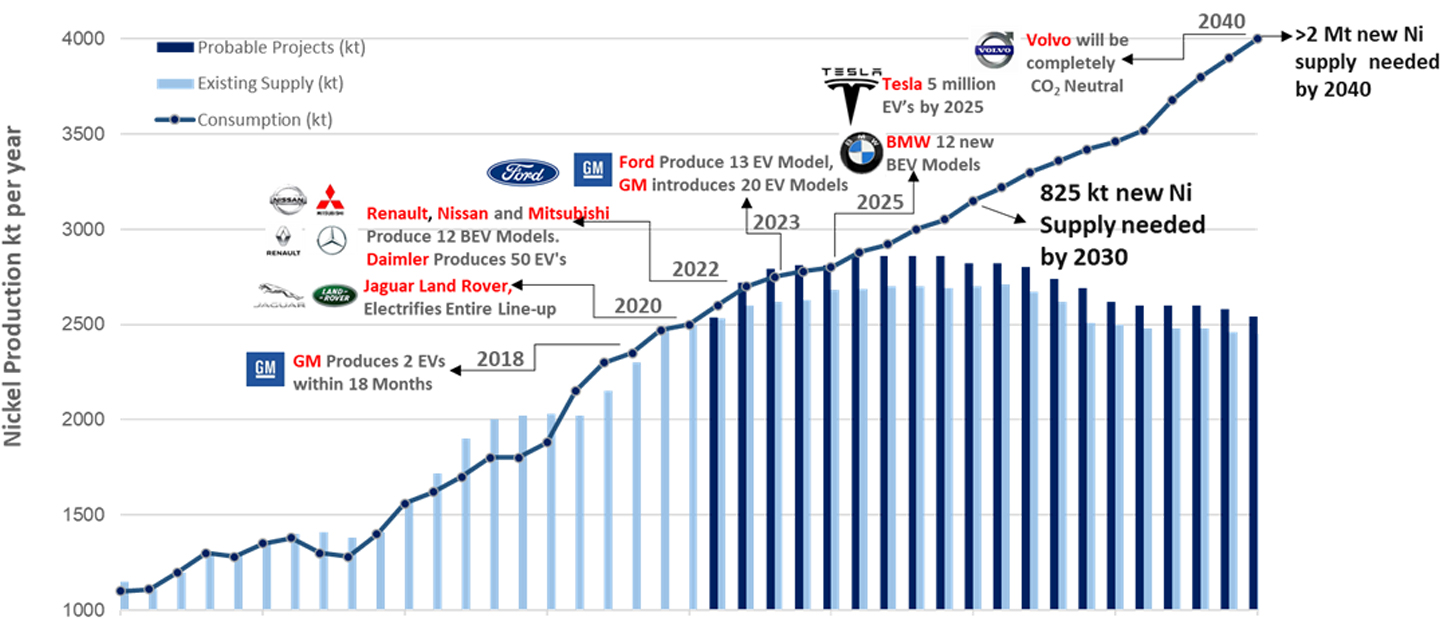

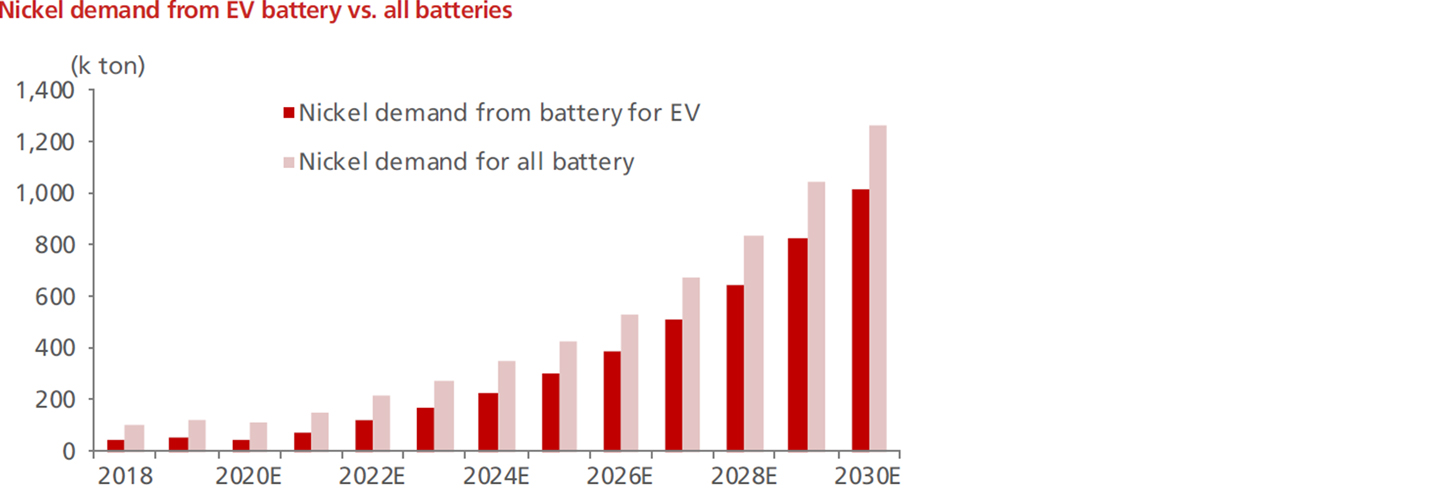

Over the last couple of years, the drivers for the nickel market have started to change, mostly attributed to the rise of the Electric Vehicle (EV’s) industry. Nickel is an essential component for the cathodes for nickel-bearing lithium-ion batteries, mainly due to its high energy density. EV sales topped 1 million globally in 2017 and hit 2 million in 2018, it reached 3.2 million in 2020 and is expected to reach 21 million EV’s sold per annum by 2030. Not included in these estimates are electric bikes and trucks, which is also starting to pick up globally.

Source: Company Press Releases

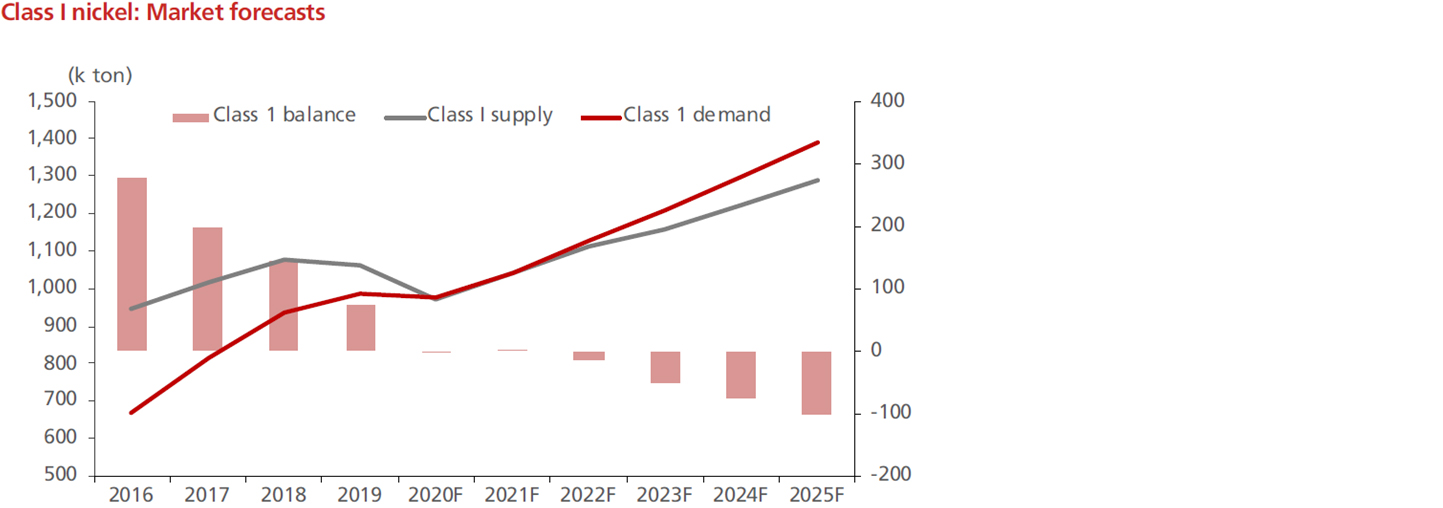

Analysts predict the exponential growth of EV’s and the resultant demand for nickel to continue growing into the foreseeable future with the demand for Class 1 nickel expected to increase from 33 Kt in 2017 to 570 Kt by 2025. The supply for Class 1 nickel is not keeping up with demand and many analysts expect a global shortfall from around 2025 due to only a limited number of Class 1 nickel deposits coming into production over the next 5 years.

Source: Company Press Releases

Source: DBS Asian Insights: October 2020 – Nickel and Battery

(https://www.dbs.com/in/sme/aics/templatedata/article/generic/data/en/GR/102020/201021_insights_nickel_battery.xml#)

Source: DBS Asian Insights: October 2020 – Nickel and Battery

(https://www.dbs.com/in/sme/aics/templatedata/article/generic/data/en/GR/102020/201021_insights_nickel_battery.xml#)

The case for environmentally friendly sustainable nickel

Nickel is a vital ingredient for the clean energy revolution and the low-carbon future of world. Unfortunately, a major part of the world’s nickel supply is still from Class 2 laterite deposits, known for its high environmental impact relative to Class 1 deposits. The problems commonly associated with Class 2 deposits are: a) generally located in protected areas with high biodiversity, b) complex processing techniques, requiring a lot more energy and chemicals to produce pure nickel; c) larger surface footprint; d) more water pollution; and e) situated in countries with less rigorous environmental legislations. The negative environmental impact of Class 2 deposits is well documented for major producing countries such as Indonesia and the Philippines. The later only recently lifting a nine-year ban on new mining operations due to the high environmental impact.

The demand for the cleaner Class 1 deposits is expected to rise significantly over the next couple of years, with very little supply expected to come online soon. This increased demand will be supported by the trend for cleaner production seen across the world, with investors and first world countries requiring a more transparent environmental, social, and corporate governance (“ESG”) approach from companies.

The combination of the small environmental footprint, large resource size and low mining and processing costs makes the Zeb Nickel Project an attractive source for environmentally friendly and cost-efficient Class 1 nickel.